In today’s digital age, mobile apps have revolutionized the way we live and work. The banking industry is no exception, and the emergence of NeoBanks has completely transformed the way we manage our finances.

A NeoBank is a digital bank that operates entirely online, without any physical branches. They offer a wide range of banking services through mobile apps and websites, making it more accessible and convenient for customers to manage their money. But the question arises, how much does it cost to develop a NeoBank mobile app? In this article, we will explore the factors that influence the cost of developing a NeoBank mobile app and provide an estimated cost breakdown.

If you are interested in fintech and want to create a Neobank startup, here is why you should do it and how much is the cost of building an app for online banking.

Modern technology and advancement are revolutionizing every industry, business, and common practice. We now got services such as Uber and Lyft to replace traditional taxi services and other platforms like Airbnb to make our lives much easier.

Everything is improving at a gradual pace except banking, which is stuck at the old and traditional practices. Now that everything else is on its way to getting better, it’s time to bring some change to the old banking services. This post will improve your understanding of Neobanks and discuss the cost of building an app to give you a deeper insight.

Read also: How To Set up and Use the Cash App?

Introduction

A NeoBank is a financial institution that operates entirely online, providing financial services through a mobile app or website. NeoBanks are entirely digital and offer faster, more efficient services with better interest rates and lower fees compared to traditional banks. With the increasing popularity of mobile banking, NeoBanks have become a preferred choice for millennials and Gen Zs. The importance of NeoBank mobile apps cannot be overstated, as they offer a wide range of services like account opening, fund transfers, bill payments, budgeting, and investing, all through a single platform.

Factors that influence the cost of developing a NeoBank mobile app

Developing a NeoBank mobile app involves various factors that impact the overall cost of the project. The cost of building an app can vary depending on several factors such as:

Platform compatibility: The mobile app needs to be compatible with multiple platforms like Android and iOS, which adds to the development cost.

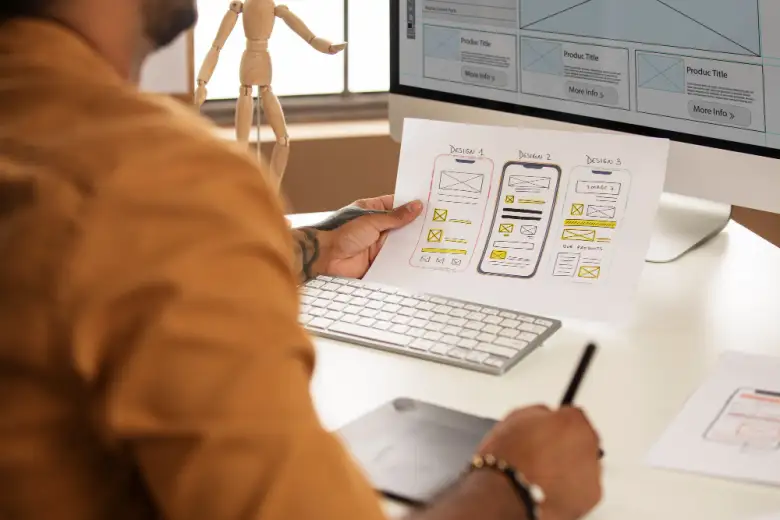

Design and User Experience (UX): Design and UX play a crucial role in attracting and retaining customers. A well-designed mobile app with a user-friendly interface can drive user engagement and brand loyalty.

Features and functionalities: The cost of building a mobile app depends on the number and complexity of features and functionalities. The more features you add, the higher the cost of development.

Security measures: Since mobile banking involves sensitive customer information, security measures are paramount. The app needs to have robust security measures in place to protect against cyber threats, which can increase the development cost.

Integration with banking systems: The app needs to be integrated with various banking systems like payment gateways and core banking systems, which can increase the overall development cost.

Team and resources: The cost of building an app depends on the size and experience of the development team, as well as the availability of resources like tools and technologies.

Estimated cost breakdown of NeoBank mobile app development

The cost of building a NeoBank mobile app can vary depending on the above factors. Here’s a rough estimate of the cost breakdown of NeoBank mobile app development:

Cost of development phases (Discovery, Design, Development, Testing, Deployment): $50,000 to $200,000

Cost of resources (designers, developers, project managers, testers): $60,000 to $150,000

Cost of tools and technologies (software licenses, hosting, security, etc.): $20,000 to $50,000

The total cost of developing a NeoBank mobile app can range from $130,000 to $400,000, depending on the features and functionalities.

How to reduce the cost of developing a NeoBank mobile app

Here are some tips to reduce the cost of developing a NeoBank mobile app:

Prioritizing features and functionalities: Instead of adding all features at once, prioritize the essential ones that are required for the initial launch.

Choosing the right development team: Hire a reliable and experienced team that can efficiently manage the development process.

Agile development methodology: Adopt an agile development methodology that emphasizes collaboration and flexibility, enabling quicker delivery and cost savings.

Using open-source technologies: Open-source technologies like React Native, Node.js, and Python can help reduce the cost of development by eliminating the need for expensive licenses.

Case studies of successful NeoBank mobile app development

Let’s take a look at some successful NeoBank mobile apps and their development costs:

Chime: Chime is a popular NeoBank mobile app that offers banking services like checking and savings accounts, debit cards, and direct deposit. Chime’s mobile app development cost is estimated to be around $70,000.

Revolut: Revolut is another popular NeoBank mobile app that offers a wide range of banking services like account opening, fund transfers, and currency exchange. Revolut’s mobile app development cost is estimated to be around $150,000.

N26: N26 is a German-based NeoBank mobile app that offers banking services like checking and savings accounts, credit cards, and investment options. N26’s mobile app development cost is estimated to be around $300,000.

How are Neobanks improving the Banking Experience?

Let’s start with a short introduction to Neobanks. As you know, the traditional bank services that every bank practices to this day are not improving at all, even with new machines and technology. That is why; it is time to transform the whole system. And the best way to do that is Neobanks. A Neobank is a digital financial company that offers a variety of services like money lending, money transfers, etc.

Everything gets done through an app as there is no physical bank which makes the process faster, simpler, and transparent. You can just pick up your phone, download a Neobanking app, create your account and use their financial services in a matter of minutes. It is a huge upgrade compared to all the wait and work you have to go through when you want to open an account or get a loan from a physical bank.

Banking App Cost Estimate

The cost of building an app depends on various factors. You need to consider the type of app you want to build, what its basic features are going to be, and how users will interact with it. When it comes to Neobank Mobiles apps, you need to do in-depth research because these apps got to have every feature that the user might need. That’s why; developing a digital banking app with all basic and some extra features to satisfy the customers costs a lot. Here are some features and estimated costs of building an app for digital banking.

- Sign-in: Every digital banking app needs a sign-in page to verify the user. To make it more secure, biometric authorization, such as face id, or fingerprint, is a must-have. (Approximate cost: 50k to 70k USD)

- Card Details: The next thing after sign-in in is the user’s card details. It gives users quick access to their account details, number, balance, payment system, etc.

(Approximate cost: 25k to 35k USD)

- Transactions: For a digital banking app, transactions and payments need to be fast, secure, and transparent.

(Approximate cost: 50k to 70k USD)

- Transaction History: Being able to review all the transaction history from all the connected bank accounts through a single app really helps out the user.

(Approximate cost: 25k to 35k USD)

- Analytics: This feature enables users to review their spending patterns and financial behavior. They can set up saving goals or budget plans or get customized reports.

(Approximate cost: 25k to 35k USD)

- Reminders and Notifications: What every digital banking app requires is the best notification system to instantly notify users about transactions and payments and remind them about financial offers.

(Approximate cost: 10k to 15k USD)

- Customer Support: Every app needs proper customer support services to interact with users and solve their issues. A digital banking app should offer technical support or special services to tackle any issue.

(approximate cost: 50k to 70k USD)

Conclusion

In conclusion, the cost of developing a NeoBank mobile app can vary depending on several factors, including platform compatibility, design and user experience, features and functionalities, security measures, integration with banking systems, and the team and resources required. The estimated cost breakdown for NeoBank mobile app development includes the cost of development phases, resources, and tools and technologies.

To reduce the cost of developing a NeoBank mobile app, it’s essential to prioritize features and functionalities, choose the right development team, use Agile development methodology, and use open-source technologies.

In case studies of successful NeoBank mobile app development, we saw examples of popular NeoBank mobile apps like Chime, Revolut, and N26, and their development costs.

While the cost of developing a NeoBank mobile app can be significant, it’s important to remember the potential return on investment (ROI) for NeoBank mobile apps. NeoBanks can offer lower fees, competitive interest rates, and convenient banking services to customers, making them a popular choice in today’s digital world.

Overall, developing a NeoBank mobile app can be a worthwhile investment for businesses looking to provide innovative banking solutions to customers. With careful planning and execution, the cost of building an app can be minimized without compromising the quality of the final product.

Image source: Freepik.com

You might also like to read