Threats of money laundering have impacted the digital world with its incorporation into financial services and other emerging markets. Back in 1988, a concern about money laundering was raised by the UN in Vienna. However, alarming conditions occurred when the estimated number of laundered money was calculated, reaching nearly 2 trillion USD.

As it was just an approximation and not the actual number, the business industry decided to take account of all the illegal operations executed in the digital landscape. There are other ways to launder money digitally, including cash payments and account takeovers. Financial funding includes 3 different stages of money laundering. No doubt, the misuse of cloud-based systems has wedged the financial sector, leading them to find robust solutions against illegal money exchange crimes.

What Money Laundering is?

Money laundering or illegal funding refers to the method of exchanging a transaction that is obtained wrongly and is shifted to a clear origin, portraying it as legal. The laundered money aimed to be used for multiple purposes that are unlawful. These activities include terrorist funding, tax evasion, and ill-obtained incomes. The term originated from the United States, referring to the mafia people utilizing the funds for illegal purposes. In other words, illegal money is the underground movement of cash transferring from one region to the other dodging the legal systems.

Explore Distinct Money Laundering Approaches

Transferring illegal money is no big deal in a world where everything is operated digitally. Imposters and other financial criminals are involved in several techniques for laundering payments and dodging the government systems. These approaches include:

- Muling money

- False invoices

- Manipulating digital industry

- Online deposit patterns

- Several bank transactions

- Money trafficking, etc.

These are some of the ways to execute illegal funds without getting caught. However, all these processes result in losing the company’s reputation and asset loss. Furthermore, stages of the money laundering process stages are discussed in detail.

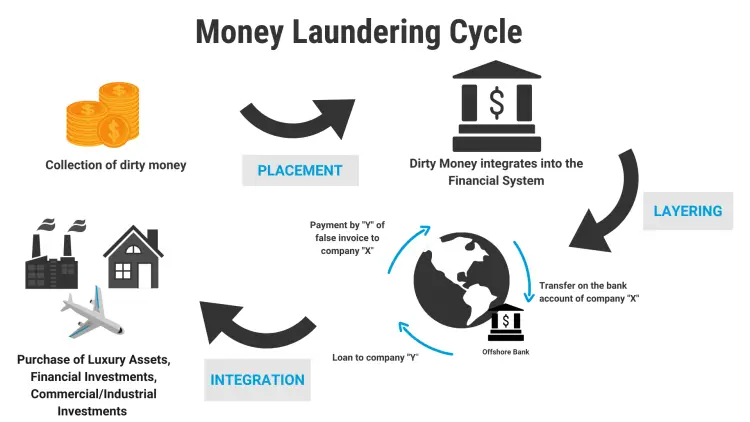

Primary Stages in Money Laundering

Let’s dive into the detailed analysis of how money is laundered in three primary stages concerning the financial system to incorporate instant solutions.

- Placement

Placement refers to the initial stage in the illegal funding operation. The prime concept of the word is to access the medium manipulation to place the money in the legal economy. The process works by getting illegal transactions and discovering the placements in the financial sectors to split massive transactions into chunks. The whole strategy makes it complex for companies to detect illicit money exchanges and assists fraudsters in tricking the systems.

- Layering

In this stage, the fraudsters create multiple layers of the transaction, making it complicated for the financial sector to inspect illegal money. It helps the imposters to transfer further laundered money by blending the funds with legal money exchange. Also, it is referred to as one of the complex phases of money laundering.

- Integration

Lastly, the criminals involved integrating illegal cash payments and other transactions obtained. Integration includes enabling the scammers to dodge the system and pass the laundered money without having the fear of being caught. The integration phase puts back the laundered transactions to the imposters while emulating it to be gained by a legal source.

How Anti-Money Laundering Standards Assist in ML Preventions

Money laundering crimes have reached a point where businesses require instant solutions with strong approaches; the AML standards and compliance have made it possible for them to encounter such activities. Anti-money laundering stages develop check methods and provide insights into illegal money exchanges. This assisted the digital industry in screening and inspecting the transaction, making it feasible for companies to incorporate. Listed down are some of the solutions AML checks integrate:

- Risk Assessment

- Continuous screening

- Payment monitoring system

- Sanction screening

- Adverse monitoring method

- AML for businesses

- Fraud inspection

- Customer verification

- Batch screening etc.

All these work on a single principle of inspecting illegal or uncertain transactions while protecting the industry against fraudulent operations. It includes the two-way screening of consumers using APIs and a record storage approach. The AML process works instantly with extensive proof of verification.

You might also like to read

How to Get More Customer Reviews?

How Long Will It Take Me to Get to Work Every Day?

Conclusion

Companies working in the financial sector and dealing with finances require customer verification and screening to protect businesses. The AML screening and ongoing approach assist in inspecting the stages of money laundering while offering a seamless onboarding experience to new consumers. Validating the businesses against the sanction list helps in reducing the red flags of AML. Moreover, the whole method is fully automated and involves an exhaustive AML database. Money laundering stages can be encountered with enhanced data security and an interactive user interface for easy integration.